Abstrict

This paper critically examines Pakistan’s fiscal federalism and highlights the challenges posed by the 18th Constitutional Amendment 2010. The research is contextualized within the broader theoretical framework of fiscal federalism. Although intended to decentralize power and grant fiscal autonomy to provinces, the amendment has created structural fiscal issues, especially within the National Finance Commission. Locking of the provincial NFC share, lack of consensus building on the NFC Award since 2009, stagnant fiscal space and tax-to-GDP ratio, vertical fiscal imbalance, and absence of a joint fiscal responsibility mechanism have a negative bearing on the macroeconomic stability of Pakistan. Limited fiscal decentralization to local governments further restricts equitable development at the grassroots level. Key recommendations include operationalizing the NFC Secretariat, revising fiscal frameworks, incentivizing provincial tax efforts, and enhancing collaboration through the Council of Common Interest to strengthen fiscal management and cohesion.

Keywords

Fiscal Federalism, 18th Constitutional Amendment, Fiscal Decentralization, Fiscal Autonomy, Economic Instability, National Finance Commission Award

Introduction

Pakistan pursued a centrally planned paradigm of economic development until the ratification of the 18th Constitutional Amendment in 2010, which drastically altered the politico-administrative landscape of the country, thereby granting enhanced autonomy to the provinces (Arif, 2018). The decentralization of administrative structures under the historic Amendment is seen as a fundamental shift in the division of powers and resources between the federal government and its federating units (PIDE, 2016). The spirit of the said Amendment was to grant greater administrative and fiscal autonomy to provinces. Still, the policy focus remained on the delegation of authority and power to provinces in the post-2010 milieu, and the most complicated aspect of the said Amendment about the fiscal framework for the sharing of national resources was not given due consideration (IMF, 2017). The decentralization arrangement envisaged under the said Amendment has been inadequate in strengthening fiscal federalism in Pakistan (Khalid & Hussain, 2018). Though the 18th Constitutional Amendment strengthened federalism in its political constructs, it however failed to provide sufficient safeguards against inherent pitfalls in the fiscal framework, which is adversely affecting national cohesion. In addition, the absence of a joint fiscal responsibility mechanism between the federal government and the provinces to effectively address the macroeconomic challenges has once again triggered the debate to rethink fiscal federalism in Pakistan. Fiscal federalism envisaged under the constitutional framework has not been given due consideration since the primary focus in the post-18th Amendment milieu has been on the politico-institutional devolution of power and authority to the provinces. The absence of adequate safeguards against pitfalls such as perennial lack of consensus building on the mandatory National Finance Commission (NFC) Award and non-operationalization of the NFC Secretariat, inter alia, is exacerbating the mistrust between the federal government and the provinces. Besides, increased horizontal and vertical imbalances, over-reliance of provinces on receipts from the federal divisible pool, absence of incentives to expand the provincial tax base, non-trickling of fiscal decentralization to the local government level, etc., necessitate revisiting the fiscal federalism amidst the economic instability in Pakistan.

Research Questions

1. What is the status of fiscal federalism in the post-18th Amendment milieu?

2. What are the fiscal pitfalls under the existing constitutional framework that necessitate revisiting fiscal federalism in Pakistan?

3. How can fiscal federalism be strengthened?

Literature Review

Fiscal federalism, a widely debated topic in public

finance, involves the division of governmental functions and finances across different levels of government (Musgrave, 1959). It aims to determine the optimal allocation of functions and instruments between centralized and decentralized tiers of government (Oates, 1999). In essence, it addresses the distribution of fiscal responsibilities, including expenditure and revenue generation, among vertical tiers of government.

Fiscal decentralization, a related concept, involves the transfer of financial resources from higher to lower levels of government, accompanied by increased autonomy in managing and utilizing these resources, including budgetary and spending decisions (Asquer, 2018; Pasha & Pasha, 2000). The core components of fiscal federalism include exclusive and shared tax bases, revenue-sharing mechanisms, tax and expenditure harmonization, and intergovernmental transfers and grants (Hobson, 2018). Musgrave (1959) proposed a three-branch taxonomy of government functions: resource allocation, income redistribution, and macroeconomic stabilization. Resource allocation aims to correct market inefficiencies, while income redistribution seeks to ensure fair and equitable distribution of resources. Macroeconomic stabilization involves fiscal and monetary policies to maintain economic stability (Jabeen, Ali, & Ahmad, 2023; Ali, et., 2023). The theoretical evolution of fiscal federalism has undergone two major phases: the First-Generation Theory (FGT) and the Second-Generation Theory (SGT). The FGT posits that neither a fully centralized nor a fully decentralized system is optimal. State and local governments may focus on providing specific public goods and services within their jurisdictions, while the federal government may prioritize national-level public goods and services or those requiring economies of scale (Arif, 2018; Oates, 1972; Olson, 1969; Dilshad, Shah, & Ahmad, 2023). The SGT, on the other hand, emphasizes resource generation autonomy for state and local governments to improve service delivery, accountability, and transparency (Oates, 2005; Khoso, Oad, & Ahmad, 2023; Ali, et al., 2023; Naeem, Ali, & Ahmed, 2022). However, federalism in developing countries may lead to intergovernmental inconsistencies and hinder integrated policymaking (Wibbels, 2005; Haider, Ahmad, & Ali, 2024). Economic adjustment and macroeconomic stability remain crucial challenges for developing economies, and Pakistan's fiscal federalism is no exception to these issues, as will be discussed in subsequent sections.

Shahid et al. (2024) argue that tax decentralization can stimulate economic growth, whereas strong political institutions may hinder it. By transferring tax collection responsibilities from the federal to the provincial level, provincial governments can potentially achieve better outcomes and economic efficiency. Hasna (2023) maintains that Pakistan's constitution outlines a clear framework for revenue distribution, but practical challenges in the fiscal relationship between the federal government and Khyber Pakhtunkhwa hinder a smooth working relationship. Agrawal et al. (2024) examined the efficiency and equity implications of fiscal decentralization, fiscal competition, and fiscal externalities and concluded that economic, technological, and environmental factors, along with globalization, polarization, and global crises, are shaping the future of federal systems. Khan et al. (2023) contend that Pakistan’s economy is burdened by persistent budget deficits, soaring public debt, and rampant inflation. These issues, coupled with a lack of accountability and fiscal mismanagement, have raised concerns about the sustainability of the country's federal structure. There is no dearth of studies on fiscal federalism in Pakistan; however, none extensively analyses this widely contested topic within the broader theoretical and constitutional framework, especially in the post-18th Constitutional Amendment milieu, which this study addresses, in addition to making pragmatic recommendations to restructure the fiscal federalism amidst economic instability in Pakistan.

Research Methodology

The research uses a qualitative approach, primarily relying on document analysis and critical discourse analysis. Key documents, including the 18th Constitutional Amendment, NFC Awards, government budgets, economic surveys, etc., were meticulously analyzed, embedding the study strongly in the theoretical frameworks concerning fiscal federalism. By critically examining these sources, the study delves into the complexities of Pakistan's fiscal federalism, identifying key issues and proposing policy recommendations for a more equitable and efficient fiscal framework.

Results and Discussion

The 18th Amendment was ratified by the Parliament in 2010 to strengthen fiscal federalism and to realize the benefits of decentralization. It is, however, argued that the design of fiscal federalism, more than the degree of decentralization, has a strong bearing on the macroeconomic outcomes of a country (Ter-Minassian & Fedelino, 2010).

Fiscal Federalism in the Post-18th Amendment Period

The 18th Constitutional Amendment significantly curtailed the federal government's powers and abolished the Concurrent List, transferring most subjects, including social services like health and education, to the provinces. This marked a turning point in Pakistan's fiscal federalism, necessitating a re-evaluation of revenue and expenditure assignments at different government levels. While tax assignments remained largely unchanged, the Amendment clarified expenditure responsibilities for the federal and provincial governments.

The Council of Common Interest (CCI), established under Article 153 of the Constitution, is chaired by the Prime Minister and includes Chief Ministers to resolve intergovernmental disputes related to the Federal Legislative List. Additionally, the Amendment mandated provincial devolution of administrative, political, and financial authority to local governments under Article 140(A). The National Economic Council (NEC), established under Article 156, reviews the country's overall economic condition and advises the federal government and provinces on socioeconomic planning.

Under Article 160, the National Finance Commission is constituted by the President, at an interval not exceeding five years, to make recommendations to the President as to the distribution of resources between the federal government and the provinces, making grant-in-aid to the provinces, inter alia. Key features of the 7th NFC Award are as follows:

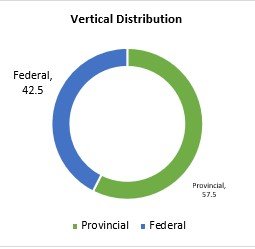

The 7th NFC Award significantly increased the share of provinces in vertical resource distribution from 47.5% in FY 2009-10 to 57.5% (Iqbal & Sabir, 2018). ii) Before 2009, NFC Awards were solely based on population. However, the 7th NFC Award introduced a multi-factor horizontal distribution formula, considering poverty/backwardness (10.3%), inverse population density (2.7%), revenue collection/generation efforts (5%), and population (82%). This benefited Balochistan and KPK provinces, with their shares increasing from 5.11% and 13.82% under the 5th NFC Award to 9.09% and 14.62%, respectively, under the 7th NFC Award (ibid). General Sales Tax (GST) on Services was devolved to provinces. The federal government reduced the collection charges from 5% to 1%, thereby expanding the size of the Divisible Pool of federally collected taxes.

Moreover, two clauses, 3(A) and 3(B), were added to Article 160, which stipulate that the share of the provinces in each Award of NFC shall not be less than the share given to the provinces in the previous award and that the federal minister and the provincial finance ministers shall monitor the implementation of the award bi-annually and lay their reports before both houses of the parliament.

Figure 1

Source (Iqbal & Sabir, 2018)

Figure 2

Source (Iqbal & Sabir, 2018)

Figure 3

Pitfalls in the Fiscal Framework of Pakistan

Locking of NFC Share of Provinces

The share of provinces was locked under Article 160(3A) of the Constitution, which states that the share of the provinces in each Award of NFC shall not be less than the share given to the provinces in the previous Award. This clause has made the NFC Award static, thereby not leaving any extra fiscal space for the federal government to adjust in the wake of any contingency or fiscal shock.

Non-operationalization of NFC Secretariat

The most complicated aspect of the said Amendment about the fiscal framework for sharing of national resources, whose ambit falls under the politico-technical forum of NFC, was not given due consideration. The necessary institutional arrangement was required to be made through the operationalization of the NFC Secretariat to regularly monitor the implementation of the NFC Award.

Lack of Consensus Building between the Federal Government and Provinces

In addition to the non-operationalization of the NFC secretariat, the inordinate delay in building consensus on the NFC Award since 2009 is adversely affecting national cohesion and has further deepened the already trust-deficit relationship between the centre and the federating units. However, this is not a new phenomenon, as the political history is rife with such instances. Since the promulgation of the constitution in 1973, only four out of nine NFC Awards have proved to be decisive so far, while meetings of the NFC have been held regarding the finalization of the 10th NFC Award, as shown below.

Table 1

Source (Ministry of

Finance, Government of Pakistan)

|

4th

NFC |

1991 |

Decisive |

|

5th

NFC |

1997 |

Decisive |

|

6th NFC |

2002 |

Indecisive |

|

7th

NFC |

2009 |

Decisive |

|

8th NFC |

2010 |

Indecisive |

|

9th

NFC |

2015 |

Indecisive |

|

10th NFC |

2020 |

NFC meetings held! |

Absence of Safeguards against Pitfalls

Mature and effective fiscal federalism encompasses a robust intergovernmental mechanism for the synergy of fiscal policy, whereby irritants, if any, can be removed through mutual deliberations. However, the forums of CCI and NFC have not lived up to their constitutional mandate, and resultantly, coordination between the federal government and the provinces remains a weak link (Boadway & Shah, 2007; (Ahmed, 2022). However, fiscal federalism under the 18th Amendment lacked a mechanism to tackle the above-mentioned pitfalls.

Fiscal Decentralization Took Place before Functional Decentralization

The 7th NFC was announced well before the 18th Amendment. It suggests that fiscal decentralization took place well before functional decentralization, which is against the spirit of public finance. Ideally, functional decentralization ought to have taken place before the fiscal decentralization to justify the enhanced resource allocation to provinces for service delivery under the increased functional mandate.

Stagnant Fiscal Space and Tax-to-GDP Ratio

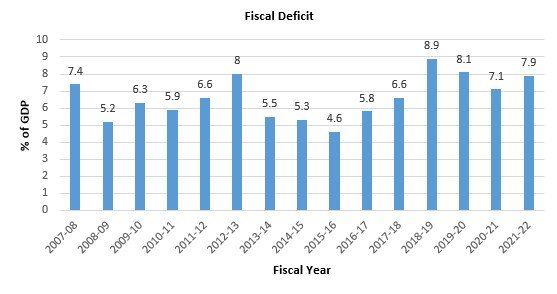

Further, the provincial share/allocations under the 7th NFC were enhanced; however, without making any binding provision for increased revenue generation by provinces and their role in the macroeconomic stability of the country. Therefore, provinces are now cash-rich and mainly dependent on the flow of receipts through the divisible pool of federally collected taxes. On the other hand, the federal government is mired in a huge fiscal deficit, burgeoning public debt, and other economic ailments. In this regard, the Tax-to-GDP Ratio and the share of both the federal government and provinces in tax collection in the pre-and post-7th NFC period are shown as follows:

Data in Figure-4 shows that the Tax-to-GDP ratio has remained almost stagnant, having fluctuated between 8.50 and 10.8% during the last fifteen (15) years.

Vertical Fiscal Imbalance

Absence of a Joint Fiscal Responsibility Mechanism for Macroeconomic Stability

The below Figure-6 suggests that the NFC share of

Punjab increased from Rs.228 billion in FY. 2007-08 to Rs.1786 billion in FY 2021-22 at an annual increase of 16%, whereas budgetary allocations for Development and Current (Non-Development) sectors increased by 14% annually during the same period, which suggests that enhanced revenue receipts under the NFC have resulted in increased spending trends for both Development and Current sides of the Budget in Punjab.

Similarly, despite worsening macroeconomic conditions in the shape of negative real growth in tax collection (discounting inflation) and mounting fiscal deficit, which is mainly financed by the federal government through debt, the provincial share under the NFC has increased unabated, as shown in Figure 6. In addition to the increased autonomy, the power of provinces under Article 167, clause 4, to raise international loans also increases the hardship of the federal government. Resultantly, the lack of stabilization effort on the part of the provinces and fiscal coordination is strikingly evident. This is mainly due to the binding nature of the Article 160(3A). Apropos, the 18th Amendment, while granting enhanced autonomy, failed to address these pitfalls.

Figure 7

Source (Fiscal Operations, Ministry of Finance, Government of Pakistan)

Figure 8

Source (Fiscal Operations, Ministry of Finance, Government of Pakistan)

Figure 9

Source (Fiscal Operations, Ministry of Finance, Government of Pakistan)

Non-trickling of Fiscal Decentralization at the Local Government Level

Provinces have, unfortunately, not shown any proclivity towards devolution of fiscal, administrative, and political authority and responsibility under Article 140(A) of the Constitution and as per the aspirations of the 18th Amendment.

Overstretching by the Federal Government in Provincial Matters

Despite acute fiscal constraints and a volatile macroeconomic situation, the federal government has constrained itself by financing key provincial matters such as subsidy on fertilizer, Public Sector Development Program encompassing development schemes of provinces, Social Safety Nets such as BISP, Ehsaas Rashan Program, Universal Health Insurance, etc. which is against the canons of prudent financial management as well as the spirit of decentralization.

Conclusion

The aspirations of fiscal federalism have not been realized under the 18th Amendment. Given the volatile economic situation and deepening mistrust between the federal government and provinces, it is high time to address the above-said pitfalls by revisiting fiscal federalism in Pakistan.

Recommendations

o The fora of CCI and NEC may be effectively utilized to build consensus on all outstanding issues, including vertical and horizontal distribution of resources in line with the functional jurisdiction of each tier of the government, as well as to forge a broader political consensus on key socio-economic challenges facing the country.

o Further, operationalization of the NFC secretariat may be assigned top priority, which can be instrumental in real-time monitoring of the implementation of NFC.

o Moreover, the existing fiscal framework under the NFC may be made flexible and dynamic. Accordingly, Article 160(3A) may be deleted in consultation with the provinces, and the resource sharing criteria, as well as the weight of different factors in the resource distribution mechanism, may be visited regularly, thereby enabling the federal government and the provinces to effectively adjust to the prevailing macroeconomic situation.

o Keeping in view the mounting public debt, it is high time that a stringent joint fiscal responsibility mechanism, encompassing fiscal responsibility and debt limitations of all tiers of the government, be put into place.

o Tax efforts may be further incentivized in the NFC Award to reduce the vertical fiscal imbalances.

o Additionally, efforts may be made to introduce tax reforms espoused by sustainable growth of all economic sectors.

o Furthermore, consensus may be forged amongst the federal government and the provinces to establish a National Development Fund for the execution of mega development projects such as dams, etc. Royalty may accordingly be shared as per the fiscal contribution.

o The flow of funds to the LGs under the PFC should be ensured to realize the aspirations of fiscal decentralization envisaged under the 18th Amendment. Besides, a robust framework for enhancing the institutional capacity of LGs in generating revenues will be crucial.

o The focus of NFC should be on the reduction of vertical and horizontal imbalances through expenditure and resource generation assignment.

o Efficiency of public expenditure by the federal government and provinces may be ensured.

References

-

Agrawal, D. R., Brueckner, J. K., & Brülhart, M. (2024). Fiscal federalism in the Twenty-First century. Annual Review of Economics. https://doi.org/10.1146/annurev-economics-081623-020713

- Arif, U. (2018). Fiscal federalism, governance, macroeconomic performance, and economic growth: An analysis with special reference to Pakistan. Quaid-i-Azam University, Islamabad. http://prr.hec.gov.pk/jspui/handle/123456789/9433

- Ali, Z., Ullah, N., Ahmad, N., Yaqoob, N., & Saba, F. (2023). Teachers’ perceptions of curriculum change and the need for professional development for effective teaching practices. Multicultural Education, 9(1), 83–90.

- Ali, Z., Younis, S., Ahmad, N., Saba, F., & Ullah, N. (2023). Teachers’ Perspective of Technology Integration Effects on Students Learning At University Level. GRADIVA, 62(5), 29–38. http://dx.doi.org/10.17605/OSF.IO/93STM

- Asquer, A. (2018). Public sector revenue. Routledge.

- Aslam, R., Iqbal, S., & Ahmed, N. (2022). Impact of entrepreneurship education on students’ entrepreneurial inclination: A case of public sector universities. Pakistan Journal of Educational Research, 5(1), 51–65. https://doi.org/10.52337/pjer.v5i1.432

- Boadway, R., & Shah, A. (2007). Intergovernmental fiscal transfers: Theory and practice. The World Bank. https://openknowledge.worldbank.org/entities/publication/141ce28b-a090-5310-9f25-88fe04bde211

- Dilshad, S. A., Shah, R., & Ahmad, N. (2023). Implementation of Single National Curriculum at Primary Level: Problems And Practices In District Khushab. Journal of Positive School Psychology, 7(4), 465–476.

- Haider, K., Ahmad, N., & Ali, Z. (2024). Problems and Challenges Faced by Non-Muslim Students in achieving Higher Education at universities of Pakistan: An Evaluative Study. Deleted Journal, 3(1), 265–290. https://doi.org/10.62681/sprypublishers.scep/3/1/15

- Hasna, 2023. Fiscal Federalism: An Analysis of Khyber Pakhtunkhwa's Share in the National Resources in the post-18th Amendment Period. Global Political Review, VIII(III), 1–10. https://doi.org/10.31703/gpr.2023(viii-iii).01

- Hobson, A. R. (2018). Fiscal federalism in Myanmar. The Asia Foundation. https://www.themimu.info/sites/themimu.info/files/documents/Training_Fiscal_Federalism_in_Myanmar_-_Policy_Dialogues_for_Peace.pdf

- IMF. (2017). Fiscal decentralization and macroeconomic challenges in Pakistan. IMF Staff Country Reports, 71. https://www.elibrary.imf.org/downloadpdf/journals/002/2017/213/article-A003-en.pdf

- Iqbal, M. A., & Sabir, M. (2018). Strengthening fiscal federalism in Pakistan: The way forward. Social Policy and Development Centre.

- Jabeen, M., Ali, Z., & Ahmad, N. (2023). Factor Effecting on Quality Teaching Learning at Public Sector Schools in Karachi Pakistan. Journal of Educational Research and Social Sciences Review (JERSSR), 3(1), 92–98.

- Khalid, P. D., & Hussain, M. N. (2018). Financial Federalism in Pakistan: Implications for Centre-Province Relations. Journal of Political Studies Vol. 25, Issue - 1, 33:53.

- Khan, M. a. M. (2023). Issues in Fiscal governance: A case of Pakistan. Journal of Development and Social Sciences, 4(III). https://doi.org/10.47205/jdss.2023(4-iii)23

- Khoso, N. F. J., Oad, N. L., & Ahmad, N. N. (2023). Exploring teachers’ perspectives on effective leadership styles at secondary level in Karachi, Pakistan. Voyage Journal of Educational Studies, 3(4), 209–226. https://doi.org/10.58622/vjes.v3i4.104

- Ministry of Finance. (2022, November 8). Fiscal operations. Finance Division. http://www.finance.gov.pk/fiscal_main.html

- Musgrave, R. A. (1959). The theory of public finance. McGraw-Hill.

- Naeem, S., Ali, Z., & Ahmed, N. (2022). Evaluation of the Causes of Interest Decline in the Subject of Chemistry amongst Secondary and Higher Secondary School Students in Karachi Pakistan. International Journal of Social Science & Entrepreneurship, 2(2), 175–184. https://doi.org/10.58661/ijsse.v2i2.48

- Oates, W. (1972). Fiscal federalism. Harcourt Brace Jovanovich.

- Oates, W. E. (1999). An essay on fiscal federalism. Journal of Economic Literature, 37(3), 1120–1149. https://doi.org/10.1257/jel.37.3.1120

- Oates, W. E. (2005). Toward a Second-Generation theory of fiscal federalism. International Tax and Public Finance, 12(4), 349–373. https://doi.org/10.1007/s10797-005-1619-9

- Olson, M. (1969). The principle of ‘fiscal equivalence’: The division of responsibilities among different levels of government. American Economic Review, 59(2), 479–487.

- Pasha, A. G., & Pasha, H. A. (2000). Devolution and fiscal decentralisation. The Pakistan Development Review, 39(4II), 981–1011. https://doi.org/10.30541/v39i4iipp.981-1011

- PIDE. (2016). Fiscal federalism in Pakistan: Need for a revisit. PIDE Policy Viewpoint, 4.

- Shahid, M., Ahmad, K., Naushahi, M. M., & Inayat, M. A. (2024). Tax decentralization and Economic Growth of Pakistan: the role of political institutions. Bulletin of Business and Economics (BBE), 13(1). https://doi.org/10.61506/01.00195

- Ter-Minassian, T., & Fedelino, A. (2010). Impact of the global crisis on Sub-National governments’ finances. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1985235

- Wibbels, E. (2005). Federalism and the market. https://doi.org/10.1017/cbo9780511510441

Cite this article

-

APA : Raza, M. A. (2024). Navigating Fiscal Federalism in Pakistan: Balancing Decentralization and Economic Stability Post-18th Amendment. Global Political Review, IX(IV), 80-91. https://doi.org/10.31703/gpr.2024(IX-IV).07

-

CHICAGO : Raza, Muhammad Asif. 2024. "Navigating Fiscal Federalism in Pakistan: Balancing Decentralization and Economic Stability Post-18th Amendment." Global Political Review, IX (IV): 80-91 doi: 10.31703/gpr.2024(IX-IV).07

-

HARVARD : RAZA, M. A. 2024. Navigating Fiscal Federalism in Pakistan: Balancing Decentralization and Economic Stability Post-18th Amendment. Global Political Review, IX, 80-91.

-

MHRA : Raza, Muhammad Asif. 2024. "Navigating Fiscal Federalism in Pakistan: Balancing Decentralization and Economic Stability Post-18th Amendment." Global Political Review, IX: 80-91

-

MLA : Raza, Muhammad Asif. "Navigating Fiscal Federalism in Pakistan: Balancing Decentralization and Economic Stability Post-18th Amendment." Global Political Review, IX.IV (2024): 80-91 Print.

-

OXFORD : Raza, Muhammad Asif (2024), "Navigating Fiscal Federalism in Pakistan: Balancing Decentralization and Economic Stability Post-18th Amendment", Global Political Review, IX (IV), 80-91

-

TURABIAN : Raza, Muhammad Asif. "Navigating Fiscal Federalism in Pakistan: Balancing Decentralization and Economic Stability Post-18th Amendment." Global Political Review IX, no. IV (2024): 80-91. https://doi.org/10.31703/gpr.2024(IX-IV).07