Abstrict

This study purposes to estimate the Pakistan’s informal economy by indirect methods and estimate the causes behind the informal economy. Ordinary least square is used for estimation of causes behind the informal economy. From GDP approach, conclude that informal economy is increasing while employment approach shows decreasing informal economy. The estimated result shows tax evasion is the main reason behind the informal economy in Pakistan. In our study, particular implications of the informal economy are identified. Informal economy plays a main role in income inequality and reducing the poverty. It limits implementing the operative public policy. The government should make such policies to control the informal economy and increasing tax evasion and corruption. If government formalize the informal economy by registering them at low cost, make the registration process easier and lower the amount of taxes imposed on them, the country’s growth will be doubled.

Keywords

Informal Economy, Indirect Approaches, GDP Approach, Formal Economy

Introduction

Informal economy constitutes a varied group of activities, businesses, employment, and workforces that are not regulated or sheltered by the law. Such self-employment in unregistered ventures is usually related to the informal economy. It is also comprised of wage employment in unprotected enterprises. Initially, Keith Hart introduced the term informal economy in 1970. He described the informal economy as an occupation outside of government and categorized it into legitimate and illegitimate activities. Feige (1990) classified the underground economy as, an unrecorded economy, unreported economy, informal economy, and illegal economy. The reason for the promotion of an informal economy in a system is the authority's failure to recognize the property rights and agreements of contracts. That is the reason that the informal economy is hard to measure as it is unrecognized by the government. Like other countries, the informal economy survives in Pakistan, and due to this reason, socioeconomic problems are rising which increases the fiscal deficit that in turn reflects a loss in tax revenues. However, public revenues grow in the formal economy at a slower rate. Moreover, the precise estimation of the informal economy shows that it is significant for the growth of the economy of Pakistan. Like the informal economy, tax evasion has also been a major problem in Pakistan resulting from continually low tax flexibility and low tax reforms. The informal economy can also be measured by the GDP approach or the discrepancy approach. To measure the informal economy of the United States, Park (1979) uses a discrepancy approach which shows the difference between national expenditure and income. To measure the informal economy, the discrepancy approach can be used at both the national level as well at the individual level Schneider and Enste (2000). Ogunc and Yilmaz (2000) by using the same approach measure the extent of the underground sector of Turkey's economy. Boka & Torluccio (2013) use a discrepancy approach to measure Albania's informal economy by utilizing data taken from the National Institute of Statistics of Albania (Instat) during the time period of 1996 to 2012. The major disadvantage of the discrepancy approach is that this approach is unreliable to measure the extent of the informal economy. As in Turkey where tendency is high for saving Ogunc and Y?lmaz (2000). Schneider and Ernste (2002) argue on two bases firstly this approach looks very easy but it is difficult to measure the GDP. Secondly, the expenditures cannot be estimated without any fault and its constructed components cannot be independent from income factors. Another indication of the informal economy is the employment approach or labor market approach which shows the shifting of formal labor to informal labor. As Mincer and Polacheck (1974) estimated more than 50 percent of the labor force is unreported because they are involved in illegal work or working unofficially. According to Schneider (2000), the employment approach as a decrease in official labor force participation can show increased informal activity if labor force participation is the same and all things the constant. The informal businesses in the informal sector use informal labor to avoid their illegal activities Schneider (2002). If data is available, the labor market approach gives accurate results about the extent of the informal economy in urban areas (Marcelli & Flaming, 2003). There are two major drawbacks. Firstly, the labor market approach does not count second-job employers. An individual may work in the official and unofficial economies. Secondly, the changes in labor force participation may be due to different reasons which give misleading results Schneider (2000).

Causes of Informal Economy

The informal economy and tax evasion are an intertwined problem in Pakistan. The informal economy can reflect the growth of tax evasion. Major studies have found the impact of the high taxes on the shadow economy like studies by Schneider (1994b, 2000, 2004, 2005) and Johnson, Kaufmann, and Zoido-Lobaton (1998). Their studies resulted in the significant impact of taxation on the shadow economy of Austria and the Scandinavian countries. Edlund and Aberg (2002) also depend on the result of Schneider and Enste (2000), who reported tax evasion by using the data and checking its relationship with tax levels and social tax norms. Among other factors behind the increasing informal sector, the literature discovers a high level of corruption as a dominant reason. Considerable corruption between law enforcement authorities, financial agencies, bureaucrats, politicians, and other regulators could require more bribery and larger rent-seeking in the formal sector. The relationship between corruption and the informal sector of countries appears as an obvious issue. Considering this, several studies like Johnson, Kaufmann, and Shleifer (1997), Friedman et al. (2000), Djankov et al. (2002), Dreher and Schneider (2009), and Beuhn and Schneider (2012) emphasized that there is a positive association among corruption and the informal sector and they are complementary to each other. There is a lot of literature on the relationship between the informal economy and the quality of institutions as compared to the literature on the nexus between the informal economy and financial development. Torgler and Schneider (2007), Dreher, Kotsogiannis, and McCorriston (2008), Mohommad et al. (2012), Razmi, Falahi, and Montazeri (2013), Iacobuta, Socoliuc and Clipa (2014) and Shahab, Pajooyan and Ghaffari (2015) have reported reduction in shadow economy by improvement in financial institutions. In an informal economy, economic activities are not recognized as a national income source due to non-payment of tax. However, the formal sector is clearly recognizable as the national income source because the tax is paid. With the growth in the informal economy, the socio-economic problems are rising especially, the increased fiscal deficit. Resulting in a loss in tax revenues. Government expenditures rise with the official economy as well as the informal economy whereas public revenues rise with the official economy. The precise taxation of the informal economy is valuable as it impacts other socio-economic variables. Different studies report that tax evasion is the only reason behind the informal economy but keen observation shows that corruption is the root cause of the informal economy. So the objective of the study is the estimation of the informal economy and its causes in the case of Pakistan.

Theoretical Framework

In Lima, Hernando De Soto a president of the Institute for Liberty and Democracy (ILD) guided the Institute for Liberty and Demo (ILD) regarding the term informal sector. Hernando De Soto suggests that the informal sector is the sector, which works beyond the laws and regulations of government. He collected data on the housing, transportation, and trade sectors of the informal economy. Further, they calculated the income generated by these three sectors of the informal economy and found a huge size of informal activity. He claims that the government should remove regulations on housing, transportation, and trade sectors of the informal economy and should allow in way of free market activity and capitalism. The government introduces programs planned to control the overpopulation problem, as it is the main cause of the housing. As informal housing, informal trade is considered another alternative for Peru's people to protect their private property rights. He divides informal trade into two parts i.e. informal markets and street vendors. De Soto expanded informal housing and informal trade through informal transportation. Similarly, like other informal sectors, informal transportation is divided into collective transport and minibus. In the second part of the book "The Other Path", De Soto compares the cost of the formal and informal sectors. And also estimate the role of the law in both sectors. He says "law is good", if it assures that they raise economic efficiency and "law is bad", if it delays or slows the economic efficiency. Further, He concluded his study by saying that the economic indicators of Peru show a bleak image. According to him, the informal sector is only a path to attain the goals (Misra, Kumari, & Sajid 2024 and Kishwar, Bashir, Hussain, & Alam 2023)

Econometric Model and Methodology

There are two approaches to measure informal economy i.e. direct approach and indirect approach. The direct approach is through conducting the samples and surveys but this approach is not reliable. Therefore, in our study, we use indirect approaches and through those approaches, we estimate the informal economy. The indirect approach is beneficial as compared to the direct approach because, in the direct approach, respondent does not want to recognize their informal activities. There are four types of indirect approaches i.e. discrepancy approach, monetary approach, physical input approach, and model approach.

GDP approach is also known as the discrepancy approach or accounting statistics. The GDP approach is the proportion of discrepancy between GDP by production and GDP by expenditure indicating the extent of the informal economy. If the measure of GDP by expenditure is more than the GDP by production or vice versa, it can be used as an estimator to measure the informal economy. Due to the informal economy, a discrepancy exists between them. Consequently, the additional expenditure on production signifies the extent of the informal economy. The GDP approach does not analyze the characteristics of the informal economy but only estimates the informal economy. It also excludes errors and omissions in reported income which may yield unreliable results. It can be used at national as well as individual levels. At the individual level, it gives better results as compared to the national level.

Informal economy = GDP by expenditure - GDP by production

The employment approach is also known as Labour market analysis or statistics. The employment approach states that when informal economic activities increase, there will be a decrease in labor force participation, ceteris paribus. The employment approach supposes that participation in the formal labor force remains the same. Thus, labor force participation decreases which can be supposed to assess the informal economy's growth. If data is both easily available and accessible, the employment approach provides strong pieces of evidence about the magnitude of the informal economy. This approach has its major drawback, that participation rate may decrease for factors rather than participation in the informal economy. Or maybe the workforce is involved in the official and informal economy both. It may lead to unreliable estimates.

Factors Affecting the Informal Economy

The literature cited several causes that are affecting and emerging the informal economy. These consist of the unemployment rate, poverty, the quality of institutions, the quality of governance, decline of civic virtue, increased regulation, and compulsory reduction in weekly working hours, social security contributions, retirement at an earlier age, and loyalty towards public institutions. Different studies report different causes of the informal economy but keen observation shows that corruption is the main cause of the informal economy. Other causes behind the informal economy are higher tax rates or tax evasion and financial development. To determine the causes behind the informal economy we use the regression model as follows.

IE= ??+??CO+??TE+?? FD +??OP+µ ……(1)

Where, ??, ?1, ?2, ?3 and ?4 are the parameters and ? is an error term.

In the above equation, the informal economy is taken as the dependent variable. Further other independent variables are corruption, tax evasion, financial development, and openness. From the literature, it is concluded that if corruption increases, the informal economy will also increase. So positive sign is assumed of corruption in the informal economy equation. Tax evasion has a positive significant impact on the informal economy because individuals may avoid taxes due to the high amount and registration process of the formal economy. Hence positive sign is assumed in the equation, but on the other side financial development is expected to be negative as financial development improves the informal economy decreases. It is assumed that more openness to trade leads to a greater informal economy, so it is expected positive sign.

Data Source and Construction of Variable

From the above literature, the informal economy can estimated through direct or indirect approaches. In our paper, we estimate the informal economy of Pakistan through different indirect approaches. These approaches use the following variables. GDP by expenditure which is the summation of consumption by household, government spending, investment by business, and net exports. It was taken with the base year 2005-2006 and GDP by production which is the summation of the total market value of all final newly produced goods and services by a country. Both were taken in terms of Rupee's unit. For this GDP per capita growth is used as a proxy variable. The labor force includes all individuals of working age who can produce goods and services throughout a particular time period. It sum of all individuals of working age who are already doing a job and those who are without a job. The labor force participation rate is used as the sum of the total people or individuals who are presently employed or in seek of a job. Employment was used as each person who worked and that were either paid or self-employed and population was taken as the sum of people living in a country. They were taken in terms of millions. To examine the causes behind the informal economy we take the informal economy to GDP ratio, corruption, tax evasion as GDP ratio, financial development, and openness. The informal economy consists of various groups of activities, businesses, employment, and workforces that are not controlled or protected by the state. Tax evasion indicates all the illegitimate activities through which taxes can be evaded. Financial development is the proportion of broad money to GDP ratio. Openness is exports plus imports as a percent of GDP. They were used in terms of percentage units. Corruption is transparency and accountability in the public sector to estimate the size through which executive accountability can be used. Its value varies between 1 to 6. The analysis of this research is the major macro indicator of the economy in Pakistan. Data is collected through the State Bank of Pakistan, Labour Force Statistic, UN data, and World Bank. For the gross domestic product (GDP) approach we use data from 1960 to 2017. For employment approach data use from 1991 to 2017. To determine the causes behind the informal economy, data was used from 1995 to 2017.

Result and Discussion:

Gross Domestic Product (GDP) Approach

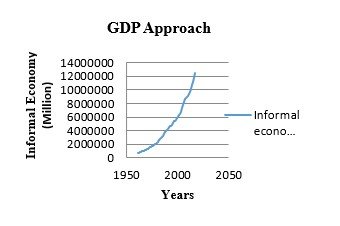

This approach is the proportion of discrepancy

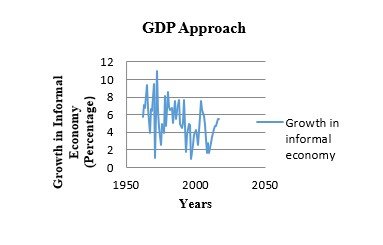

between GDP by production and GDP by expenditure, which indicates the extent of the informal economy. In Table A.1, informal estimates for the time period of 1961 to 2017. The estimated result indicates that the informal economy increased by Rs. 12408712 million over 2017, which rose from Rs. 720066 million in 1961. The informal economy recorded a high growth of 10.9 percent in 1972 and a low of 1.0 percent in 1997. The graphical method of the GDP approach is illustrated in Figure 1 which shows an increasing trend of informal economy throughout the chosen time period. The reason behind the increasing informal economy is the difference between the GDP by production and GDP by expenditure, which exists because expenditure is greater than production. The GDP approach is so adequate for Pakistan where the propensity for saving is very low, such as foreign exchange and gold does not exist. There exists no investment company investing in a powerful project which is due to the economic and political condition of the country. Whereby debt and inflation are also increasing within the time period. The imports are greater than the exports. These factors increase the informal economy continuously. As compared to the informal economy graph, the growth of the informal economy shows upward and downward trends because of the increasing and decreasing rate over the 1961 to 2017 time period in Figure 2. The increasing and decreasing trend in the growth of the informal economy is due to changes in macroeconomic indicators like consumption, saving, investment, purchasing power of individuals, exports, imports, and government spending of the country within the preceding years.

Figure 1

GDP Approach

Figure 2

GDP Approach

Employment Approach

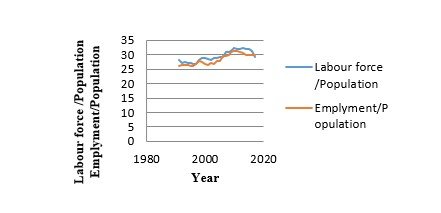

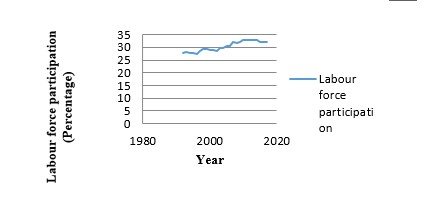

The employment approach states that when economic activities of the informal economy increase, the labor force participation will decrease, ceteris paribus. In Table A.2, the labor force/ population ratio and the employment/ population ratio move concurrently within the time. As labor force participation is increasing, this shows the informal economy is decreasing. The ratio of labor force/ population ratio and the employment/ population also show decreasing informal economic activities. Figure 3 also indicates the co-movement of the proportion of labor force/ population and the proportion of the employment/ population. This approach gives meaningful conclusions about the informal economy. And all these results show a decrease in the informal economy. As the population increases and it enrolls also continuously increases. From this opinion, a rise in these proportions, related to past years, does seem to be reasonable. The informal sector which sharply decreases as compared to the growth rate of employed labour force in the formal sector is increasing. It can be a result of the growth in Pakistan's official GDP which is due to growth led by consumption as well growth led by employment. Their growth rates of employment and labor force are negatively related to the informal sector. The labor force participation graph shows an increasing trend from 1991 to 2017 in Figure 4. The upward slope indicates a decreasing informal economy as labor force participation is increasing. Simultaneously, on the basis of the trend line of labor force participation, there is an inverse relationship with the informal economy.

Figure 3

Employment Approach

Figure 4

Employment Approach

Causes Affecting the Informal Economy

To test the stationarity the Augmented Dickey-

Fuller (DF) test has been done. The ADF test shows that the informal economy is stationary at the level but other variables, corruption, tax evasion, financial development, and openness are stationary at 1st difference as revealed in below Table 1. The optimal lag is selected on the basis of the minimum value of lags. In the lag selection criteria, lag 1 is selected as it gives a minimum value.

Unit Root Test

|

Variables |

ADF |

Conclusion of ADF |

|

Prob.* |

||

|

Informal Economy |

0.02 |

I(0) |

|

Corruption |

0.92 |

I(0) |

|

|

0.00 |

I(1) |

|

Tax evasion |

0.18 |

I(0) |

|

0.00 |

I(1) |

|

|

Financial Development |

1.00 |

I(0) |

|

0.00 |

I(1) |

|

|

Openness |

0.74 |

I(0) |

|

|

0.00 |

I(1) |

*I(0) indicate stationary at level

*I(1) indicate

stationary at 1st difference

Like the currency demand equation, the informal economy equation is also estimated by the ordinary least square (OLS) technique. The estimated result is the same as our expectation. The co-efficient of corruption, tax evasion, and openness is positive according to assumption and financial development is negative. Corruption is positively significant to the informal economy which shows corruption is the cause of increasing informal economy. Tax evasion is positively affecting the informal economy. Furthermore, openness to trade is positively associated with the informal economy due to an increase in openness the informal economy also increases. As improvement in financial development decreases the informal economy. The result is also reported in Table 2. In the modernistic tax method and the current situation of the economy of the country, taxes are only levied on the official economy which leads to wealth generated from the official sector to the informal sector as well as diversion in the resources, thus increasing the informal sector through the expenditure of the official sector. The growth of tax evasion also rises even during the rapid time periods of growth while the rate of growth of taxes collected remains constant. The imposition of GST/VAT taxes decreases the purchasing power, increases the rate of smuggling, increases corruption, hikes the price of electricity and petroleum, and lowers law enforcement. Most financial transactions were done through banks. However, the result shows that the growth of the financial sector is biased and also significant size of the informal economy. Openness is a significant factor that plays a main role in increasing and decreasing rate of the Pakistan's informal economy. From a private sector perspective, corruption leads to huge and unreliable costs and resources concerning unproductive policy-induced rents. It also influences the ineffectiveness of public administration. It is the main reason behind the time and cost overruns projects of the public sector. As it is aggregates of all such costs, the costs of corruption turn out to be quite large for the society.

Regression Model Result

|

Dependent variable: Informal Economy |

|||

|

Variables |

Co-efficient |

Std.Error |

P-values |

|

D(CO) |

1.90 |

2.42 |

0.01 |

|

D(TE) |

6.73 |

1.09 |

0.00 |

|

D(FD) |

-273.31 |

4.55 |

0.00 |

|

D(OP) |

203.95 |

2.22 |

0.01 |

|

R-square0.84 |

Prob(F-statistic)0.00 |

Durbin Watson-stat 1.92 |

|

Conclusion

As the purpose of this paper is to estimate the informal economy by different indirect approaches, thus different approaches yield different results. The GDP approach highlights the high influence of the informal economy with the increasing trend while the employment approach indicates a decreasing rate informal economy which means employment is greater in the official sector as compared to the informal sector. There are several reasons behind the informal economy but according to estimated results, tax evasion was found the main factor affecting the informal economy. The study provides an essential result for policymakers. Good governance may help to decrease the informal economy and tax evasion. The easy and simple taxation registration process can reduce tax evasion and the informal economy. Economic reforms should create political stability and a struggle against corruption and tax evasion. The government should make such policies to control the informal economy and increase tax evasion and corruption.

APPENDIX

Table 3

Gross Domestic

Product (GDP) Approach

|

Years |

Informal economy

(Billion) (Pak Rupees) |

Growth in the

informal economy (Percentage) |

Years |

Informal economy

(Billion) (Pak Rupees) |

Growth in the

informal economy (Percentage) |

|

1961 |

720.1 |

|

1990 |

4098.3 |

4.4 |

|

1962 |

761.1 |

5.6 |

1991 |

4305.8 |

5.0 |

|

1963 |

814.9 |

7.0 |

1992 |

4637.5 |

7.7 |

|

1964 |

869.8 |

6.7 |

1993 |

4719.1 |

1.7 |

|

1965 |

951.5 |

9.4 |

1994 |

4895.4 |

3.7 |

|

1966 |

1015.6 |

6.7 |

1995 |

5138.4 |

4.9 |

|

1967 |

1055.9 |

3.9 |

1996 |

5387.4 |

4.8 |

|

1968 |

1125.6 |

6.6 |

1997 |

5442.1 |

1.0 |

|

1969 |

1197.9 |

6.4 |

1998 |

5580.9 |

2.5 |

|

1970 |

1311.1 |

9.4 |

1999 |

5785.1 |

3.6 |

|

1971 |

1325.9 |

1.1 |

2000 |

6031.6 |

4.2 |

|

1972 |

1470.8 |

10.9 |

2001 |

6246.0 |

3.5 |

|

1973 |

1565.3 |

6.4 |

2002 |

6402.6 |

2.5 |

|

1974 |

1637.7 |

4.6 |

2003 |

6772.5 |

5.7 |

|

1975 |

1679.7 |

2.5 |

2004 |

7283.6 |

7.5 |

|

1976 |

1762.4 |

4.9 |

2005 |

7758.4 |

6.5 |

|

1977 |

1831.3 |

3.9 |

2006 |

8216.1 |

5.8 |

|

1978 |

1980.4 |

8.1 |

2007 |

8613.2 |

4.8 |

|

1979 |

2074.2 |

4.7 |

2008 |

8759.7 |

1.7 |

|

1980 |

2251.1 |

8.5 |

2009 |

9007.8 |

2.8 |

|

1981 |

2404.8 |

6.8 |

2010 |

9152.5 |

1.6 |

|

1982 |

2562.0 |

6.5 |

2011 |

9404.0 |

2.7 |

|

1983 |

2735.7 |

6.7 |

2012 |

9733.9 |

3.5 |

|

1984 |

2874.3 |

5.0 |

2013 |

10161.8 |

4.3 |

|

1985 |

3092.5 |

7.5 |

2014 |

10636.8 |

4.6 |

|

1986 |

3262.6 |

5.5 |

2015 |

11140.1 |

4.7 |

|

1987 |

3473.1 |

6.4 |

2016 |

11755.8 |

5.5 |

|

1988 |

3738.0 |

7.6 |

2017 |

12408.7 |

5.5 |

|

1989 |

3923.4 |

4.9 |

|

|

|

Table 4

Employment

Approach

|

Years |

Labor force /Population (Percentage) |

Employment/Population (Percentage) |

Labour force participation (Percentage) |

|

1991 |

28.0 |

26.2 |

27.9 |

|

1992 |

27.2 |

26.4 |

28.1 |

|

1993 |

27.4 |

26.5 |

27.8 |

|

1994 |

27.1 |

26.5 |

27.8 |

|

1995 |

27.2 |

25.9 |

27.4 |

|

1996 |

26.8 |

25.9 |

28.6 |

|

1997 |

26.8 |

26.9 |

29.3 |

|

1998 |

28.2 |

27.8 |

29.3 |

|

1999 |

28.7 |

27.6 |

28.9 |

|

2000 |

28.7 |

26.6 |

28.9 |

|

2001 |

28.3 |

26.6 |

28.4 |

|

2002 |

28.3 |

27.0 |

29.6 |

|

2003 |

28.9 |

26.9 |

29.6 |

|

2004 |

28.9 |

27.7 |

30.4 |

|

2005 |

29.3 |

27.6 |

30.4 |

|

2006 |

29.3 |

29.7 |

32.2 |

|

2007 |

30.9 |

29.5 |

31.8 |

|

2008 |

30.9 |

29.7 |

32.1 |

|

2009 |

31.3 |

31.0 |

32.8 |

|

2010 |

32.2 |

31.1 |

32.9 |

|

2011 |

32.1 |

31.1 |

32.9 |

|

2012 |

32.0 |

30.8 |

32.8 |

|

2013 |

32.1 |

30.6 |

32.8 |

|

2014 |

32.0 |

30.0 |

32.2 |

|

2015 |

31.8 |

29.9 |

32.3 |

|

2016 |

31.2 |

29.9 |

32.3 |

|

2017 |

29.3 |

29.9 |

32.3 |

References

-

Boka, M., & Torluccio, G. (2013). Informal economy in Albania. Academic Journal of Interdisciplinary Studies. https://doi.org/10.5901/ajis.2013.v2n8p212

- Djankov, S., La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (2002). The regulation of entry. The Quarterly Journal of Economics, 117(1), 1–37. https://doi.org/10.1162/003355302753399436

- Dreher, A., & Schneider, F. (2009). Corruption and the shadow economy: an empirical analysis. Public Choice, 144(1–2), 215–238. https://doi.org/10.1007/s11127-009-9513-0

- Dreher, A., Kotsogiannis, C., & McCorriston, S. (2008). How do institutions affect corruption and the shadow economy? International Tax and Public Finance, 16(6), 773–796. https://doi.org/10.1007/s10797-008-9089-5

- Edlund, J., & Åberg, R. (2002). Social norms and tax compliance. Economic and Policy Review, 9, 201-228.

-

Feige, E. L. (1990). Defining and estimating underground and informal economies: The new institutional economics approach. World Development, 18(7), 989–1002. https://doi.org/10.1016/0305-750x(90)90081-8

- Friedman, E., Johnson, S., Kaufmann, D., & Zoido-Lobaton, P. (2000). Dodging the grabbing hand: the determinants of unofficial activity in 69 countries. Journal of Public Economics, 76(3), 459–493. https://doi.org/10.1016/s0047-2727(99)00093-6

-

Hart, K. (1970). 8. Small‐scale entrepreneurs in Ghana and development planning. The Journal of Development Studies, 6(4), 104–120. Iacobuta, A. O., Socoliuc, R., & Clipa, I. R. (2014). Institutional determinants of shadow economy in EU countries: A panel data analysis. Transformations in Business & Economics, 13(1), 34–47.

- Johnson, S., Kaufmann, D., & Shleifer, A. (1997). The unofficial economy in transition. Brookings Papers on Economic Activity, 1997(2), 159–239.

- Johnson, S., Kaufmann, D., & Zoido-Lobaton, P. (1998). Regulatory discretion and the unofficial economy. The American Economic Review, 88(2), 387-392.

- Kishwar, S., Bashir, S., Hussain, A., & Alam, K. (2023). Informal employment and catastrophic health expenditures: Evidence from Pakistan. The International Journal of Health Planning and Management, 38(4), 999–1014. https://doi.org/10.1002/hpm.3643

- Mincer, J., & Polachek, S. (1974). Family investments in human capital: Earnings of women. Journal of Political Economy, 82(2), S76–S108.

- Misra, A., Kumari, M., & Sajid, M. (2024). Role of informal sector to combat unemployment in developing economy: A modeling study. Heliyon, 10(13), e33378. https://doi.org/10.1016/j.heliyon.2024.e33378

- Mohommad, A., Singh, A., & Jain-Chandra, S. (2012). Inclusive growth, institutions, and the underground economy. IMF Working Paper, 12(47), 1. https://doi.org/10.5089/9781463937089.001

- Ogunc, F., & Yılmaz, G. (2000). Estimating the underground economy in Turkey. CBRT Research Department Discussion Paper, 15, 1-30.

- Park, T. (1979). Reconciliation between personal income and taxable income, mimeograph Washington, D.C., Bureau of Economic Analysis, 1947-1977. Bureau of Economic Analysis.

- Razmi, M. J., Falahi, M. A., & Montazeri, S. (2013). Institutional quality and underground economy of 51 OIC member countries. Universal Journal of Management and Social Sciences, 3(2), 1–14.

- Schneider, F. (1994b). Can the shadow economy be reduced through major tax reforms? An empirical investigation for Austria. Public Finance. Finances publiques, 49(Supplement), 137–152.

- Schneider, F. (2000). The increase of the size of the shadow economy of 18 OECD countries: some preliminary explanations. CESifo Working Paper Series, 306, 1-32.

- Schneider, F. (2002). Size and measurement of the informal economy in 110 countries. In Workshop of Australian National Tax Centre, ANU, Canberra.

- Schneider, F. (2004). Working in the shadow: Where Germany's economy is really growing. Springer-Verlag.

- Schneider, F. (2005). Shadow economies around the world: what do we really know? European Journal of Political Economy, 21(3), 598–642. https://doi.org/10.1016/j.ejpoleco.2004.10.002

- Schneider, F., & Enste, D. H. (2000). Shadow Economies: size, causes, and consequences. Journal of Economic Literature, 38(1), 77–114. https://doi.org/10.1257/jel.38.1.77

- Schneider, F., & Ernste, D. H. (2002). The shadow economy: An international survey (pp. 16–24). Cambridge University Press.

- Shahab, M. R., Pajooyan, J., & Ghaffari, F. (2015). The Effect of corruption on shadow Economy: An empirical analysis based on panel data. International Journal of Business, 7(1), 85–100. https://doi.org/10.22111/ijbds.2015.2202

- Torgler, B., & Schneider, F. (2007). The impact of tax morale and institutional quality on the shadow economy. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.958248

Cite this article

-

APA : Khan, R., Iqbal, N., & Rehman, A. (2024). Estimation and Causes of Informal Economy in Pakistan. Global Political Review, IX(IV), 12-23. https://doi.org/10.31703/gpr.2024(IX-IV).02

-

CHICAGO : Khan, Rohina, Nadeem Iqbal, and Aisha Rehman. 2024. "Estimation and Causes of Informal Economy in Pakistan." Global Political Review, IX (IV): 12-23 doi: 10.31703/gpr.2024(IX-IV).02

-

HARVARD : KHAN, R., IQBAL, N. & REHMAN, A. 2024. Estimation and Causes of Informal Economy in Pakistan. Global Political Review, IX, 12-23.

-

MHRA : Khan, Rohina, Nadeem Iqbal, and Aisha Rehman. 2024. "Estimation and Causes of Informal Economy in Pakistan." Global Political Review, IX: 12-23

-

MLA : Khan, Rohina, Nadeem Iqbal, and Aisha Rehman. "Estimation and Causes of Informal Economy in Pakistan." Global Political Review, IX.IV (2024): 12-23 Print.

-

OXFORD : Khan, Rohina, Iqbal, Nadeem, and Rehman, Aisha (2024), "Estimation and Causes of Informal Economy in Pakistan", Global Political Review, IX (IV), 12-23

-

TURABIAN : Khan, Rohina, Nadeem Iqbal, and Aisha Rehman. "Estimation and Causes of Informal Economy in Pakistan." Global Political Review IX, no. IV (2024): 12-23. https://doi.org/10.31703/gpr.2024(IX-IV).02